About Profectus Capital

Profectus Capital, derived from the Latin word for ‘progress,’ is committed to empowering MSMEs and schools with tailored financial solutions. Headquartered in Mumbai, with a pan-India presence across 29 locations, we provide customised business financing solutions designed to drive sustainable progress.

Our expertise spans manufacturing, services and education sectors, offering tailored SME loans such as business expansion term loans, working capital term loans, machinery & equipment finance, rooftop solar finance, supply chain finance, and NBFC finance.

We specialize in future cash flow-based underwriting to ensure businesses get the right financial support for their specific needs.

Our Vision

- We are committed to bringing business financing solutions to support their sustainable progress.

- We understand each business aspires to differentiate itself in this competitive space by being innovative and agile in its approach. Funding must thus be matched with precise requirements for maximum efficiency.

- We will play the part of a supportive, sustainable and continuous financing partner thus realising our vision of being partners in progress to small and medium businesses.

Our Mission

- We are committed to helping MSMEs secure credit and boost their growth prospects.

- At Profectus Capital, we prioritize customer-centric policies, transparent processes, and the use of technology to develop effective financial solutions.

- Our workflows are designed with flexibility in mind, ensuring that each unique aspect of an MSME's operations is considered in decision-making while safeguarding the interests of our stakeholders.

Our Values

These values are deeply embedded in every step of our journey with our partner MSMEs.

Innovation

We continuously innovate our lending solutions to meet the evolving needs of MSME businesses, delivering what matters most to their progress and success.

Transparency

We are committed to clear, honest communication, building trust and fostering long-lasting relationships with all our stakeholders.

Responsibility

We take our commitment to the progress of the MSME sector seriously, striving to create lasting value for businesses across India.

Integrity

We are steadfast in doing the right things the right way, maintaining the highest ethical standards in all our actions.

Empathy

We deeply care about the success of our stakeholders and value the diverse perspectives that guide us in making decisions.

Our Reach

Our Investors

Since its founding in 2004, Actis has raised US$19 billion in capital and has expanded its team to over 300 professionals, including 120 investment experts working across 17 global offices. Actis’ investment funds span 70 companies, collectively employing over 116,500 people worldwide, demonstrating the firm’s broad impact and influence.

Our Leadership Team

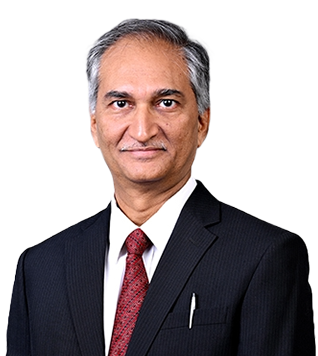

KV Srinivasan

Executive Director &

Chief

Executive Officer

Zubeen Mehrotra

Chief Business Officer

Vitthal Naik

Chief Technology Officer

Priyanka Pathak

Chief Human Resource Officer

Voice of our customers

Mr. Rakesh Kumar, Oxford Green School, Noida

“We connected with Profectus Capital when we wanted to enhance the infrastructure, modernise classrooms, labs, and facilities. Their school loan enabled us to drive a 25% rise in admissions. Their responsive service gives us confidence to grow further with them.”

Mr. Sahil Pahuja, Jospo Cooler, Delhi

“In 2022, as we set up our manufacturing unit, funding an injection moulding machine was a major challenge. A machinery loan from Profectus Capital helped us scale operations, bring manufacturing efficiencies, cut production costs, and expand our market reach.”

Mr. Arun Goel, Fortis Chairs, Haryana

“We approached Profectus Capital in 2024 as we were looking to expand our business. Their mortgage loan helped us shift and scale our plant from producing up to 50 chairs to over 1,000 per day.”

M/s Rangoli Dresses

“We needed an urgent loan to shift our existing rented space to a newly owned premises to accommodate our growing inventory. So, it was Profectus Capital that came to our rescue with fast disbursement of the loan amount.”

Anush Motors

“We needed funds for our working capital requirements. We approached Profectus Capital and they provided a loan in a hassle-free manner. They have a deep knowledge of our business. Their terms and conditions are very smooth which helped us in easy disbursal of the loan we had taken.”

Mr. Anand Goyal, Pacific Laminates

“Profectus Capital has a professional approach and dedicated team to provide finance for various needs. For my industry, my first choice would be Profectus Capital because we had a great experience with them both in terms of fast approval and smooth loan disbursal.”

Dr.A.V.NEO Tharsis, JIP Group of Hospital

“My dream of having a hospital with state-of-the-facilities was achieved with the funding from Profectus Capital.”

Mr. Dodda Gowda, Shanthi Sagar Hotel

“I had to run from one bank to another in search of loans towards funds requirements, but only Profectus capital showed trust and helped me to gain financial stability towards my hotel, which helped me in increasing revenue of my business.”

Mr. Panchakshariah, Hari Om Printers

“Compared to bank’s long waiting period, Profectus Capital’s quick turnaround time and smooth loan process was a blessing. Their understanding of my funding needs and viability-based assessment approach helped me grow my business. I would certainly recommend Profectus for equipment finance to others.”

Mr. Naveen Reddy, Spectrum Imaging

“We availed funding from Profectus to purchase a CTCP machine for our printing business. Their quick assessment and disbursal process helped us set-up the machine immediately and fulfill orders in the peak season, resulting in good business growth. Thank you Profectus!”