Customised financial solutions for Manufacturing and Service sectors

At Profectus Capital, we offer customised financing solutions designed for MSMEs like yours, whether you’re in manufacturing or services.

We understand the unique challenges of your business and use our sector expertise to tailor our term loans and working capital loans to support your progress – whether that’s for expanding capacity, modernising your setup, or meeting other business needs. What’s more? We also use cash-flow-based underwriting, so if your business has strong cash flow, we can offer the flexibility you need without relying solely on traditional collaterals.

Our goal is to make the loan process simple and straightforward, so you can focus on what matters most – strengthening your business progress!

Loans for Business

-

Mortgage Loan

-

machinery & equipment finance

-

Rooftop Solar Loan

-

School Finance

-

supply chain finance

-

NBFC Finance

-

OVERVIEW

-

FEATURES

-

ELIGIBILITY & DOCUMENTS

Our mortgage loans empower MSMEs to unlock the potential of their property, providing financial support for business growth or working capital requirements. With flexible repayment plans and industry-specific expertise, we tailor solutions to meet your unique needs and drive success.

Loan benefits include:

- Business expansion: Gain resources or space to grow your operations.

- New property purchase: Finance new locations to scale your business or open branches.

- Infrastructure upgrades: Modernise facilities to enhance efficiency and stay competitive.

- Strategic growth: Expand capacity or explore new opportunities to meet market demand.

Get the tailored funding that will help propel your business forward

- Secured Term Loans: Flexible collateral options and cash flow-based assessments tailored to your business needs, considering industry margins and future growth.

- Healthcare Loans: Designed for healthcare institutions with geographical flexibility and cash flow-based assessments.

- Working Capital Term Loan: Offers flexible repayment linked to daily credit utilization and options for monthly or quarterly repayments.

- Plot + Construction Loans: Financing for industrial/commercial plots and construction, based on property market value for maximum funding.

- Zero-Day LAP: Enables borrowing beyond the agreement value by leveraging the property’s higher market value.

-

OVERVIEW

-

FEATURES

-

ELIGIBILITY & DOCUMENTS

Profectus Capital offers tailored financial solutions to help MSMEs in manufacturing and service sectors acquire essential machinery. From CNC and injection moulding machines to medical equipment, we finance a wide range of tools across industries like manufacturing, healthcare, packaging, food processing, and more. Our expertise ensures businesses can enhance efficiency, boost competitiveness, and achieve long-term business growth.

Loan Purpose:

- Expand production capacity to meet demand.

- Upgrade machinery for better efficiency and cost savings.

- Acquire advanced technology to stay competitive.

- Improve product quality to meet industry standards.

- Loans for new and used machinery (Printing & Healthcare sectors for used).

- Flexible tenure up to 4 years.

- Funding: Up to ₹3 Cr for machinery, ₹2 Cr for solar panels.

- No secondary collateral required.

- High LTV ratio for reduced upfront costs.

- Cash flow-based assessments for tailored terms.

- Special schemes with OEMs.

- ₹50 Lakh loans for first-time machinery buyers (traders).

-

OVERVIEW

-

FEATURES

-

ELIGIBILITY & DOCUMENTS

Solar energy offers MSMEs, schools, hospitals, and commercial enterprises an effective way to reduce energy costs, improve efficiency, and support sustainability. Profectus Capital provides tailored financing for solar panel installations, allowing businesses to save on energy costs and enjoy free electricity after loan repayment.

Why Choose Profectus?

- Quick & Easy Application: Digital, hassle-free process.

- Collateral-Free Financing: Borrow up to ₹1 Crore without additional collateral.

- One-Time Investment, Lifetime Savings: Save on energy immediately and enjoy free power post-repayment.

- Positive Environmental Impact: Lower energy costs and reduce your carbon footprint.

- Higher Loan Amounts: Financing up to ₹3 Crore for solar energy needs.

- Flexible Repayment: Terms up to 4 years, based on your cash flow.

- Solar Panel Capacity: Financing for systems from 15 kW to 100 MW.

- No Secondary Collateral: No additional collateral required for loans up to ₹1 Crore.

- High LTV Ratio: A high LTV ratio covers most of the panel costs, reducing upfront investment.

-

OVERVIEW

-

FEATURES

-

ELIGIBILITY & DOCUMENTS

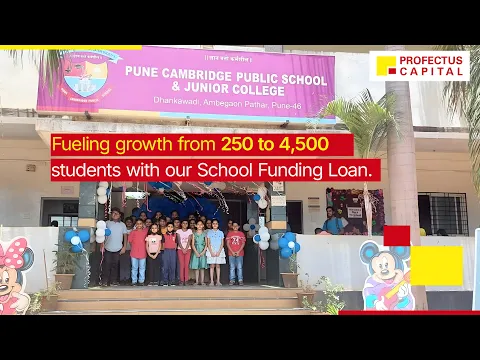

At Profectus Capital, we understand the pivotal role K-12 schools play in shaping India’s future. To stay competitive, schools need more than just skilled teachers—they need modern infrastructure, advanced educational technology, and spaces that promote holistic learning. Whether it’s expanding facilities, adding classrooms, or adopting sustainable practices like solar panels, these investments attract more students and improve financial health.

Profectus Capital offers flexible financing to help schools modernize their infrastructure and embrace green energy, supporting your commitment to academic excellence and long-term growth.

- Hassle-Free Login: Fully digital, seamless application process.

- Flexible Loan Terms: Loans from ₹25 lakh to ₹5 crore, with repayment tenures between 2 to 7 years.

- Quick Approvals: Approvals within 3 to 7 working days, based on actual cash flow assessments.

- Flexible Collateral: Accepts school properties or individual residential/commercial properties as collateral.

- Support for Non-Metro & Rural Areas: Financing available for schools in both urban and rural areas.

- High LTV Ratio: Up to 80% LTV ratio based on property market value for larger loan amounts.

-

OVERVIEW

-

FEATURES

-

ELIGIBILITY & DOCUMENTS

Supply Chain Finance (SCF) optimizes working capital by enhancing supply chain liquidity, reducing financial pressure, and boosting operational efficiency. Profectus Capital offers tailored SCF solutions, including Distributor Financing, Vendor Finance/Bill Discounting, and Merchant Cash Advance, to streamline supply chains and improve financial health.

- Faster Payments: Access funds quickly, pay suppliers on time, and strengthen relationships while benefiting from early payment discounts.

- Improved Cash Flow: Free up capital tied in receivables to invest in inventory, expand offerings, or cover operational costs.

- Flexible Financing: Choose from revolving credit, bill discounting, or merchant cash advances tailored to your needs.

-

OVERVIEW

-

FEATURES

-

ELIGIBILITY & DOCUMENTS

Non-Banking Financial Companies (NBFCs) play a key role in driving financial inclusion in India. To support their growth, Profectus Capital offers flexible Term Loans for onward lending, enabling NBFCs to expand their portfolios and serve more customers. With a focus on corporate governance, ethical lending, and innovation, we also explore Strategic Alliances with other NBFCs to drive mutual growth and create new opportunities.

- Term Loans: Funding for new portfolio creation, expanding lending capacity.

- Structured Offerings: Pool purchases and customized finance solutions to improve liquidity and strengthen balance sheets.

-

OVERVIEW

-

FEATURES

-

ELIGIBILITY & DOCUMENTS

Our mortgage loans empower MSMEs to unlock the potential of their property, providing financial support for business growth or working capital requirements. With flexible repayment plans and industry-specific expertise, we tailor solutions to meet your unique needs and drive success.

Loan benefits include:

- Business expansion: Gain resources or space to grow your operations.

- New property purchase: Finance new locations to scale your business or open branches.

- Infrastructure upgrades: Modernise facilities to enhance efficiency and stay competitive.

- Strategic growth: Expand capacity or explore new opportunities to meet market demand.

Get the tailored funding that will help propel your business forward

- Secured Term Loans: Flexible collateral options and cash flow-based assessments tailored to your business needs, considering industry margins and future growth.

- Healthcare Loans: Designed for healthcare institutions with geographical flexibility and cash flow-based assessments.

- Working Capital Term Loan: Offers flexible repayment linked to daily credit utilization and options for monthly or quarterly repayments.

- Plot + Construction Loans: Financing for industrial/commercial plots and construction, based on property market value for maximum funding.

- Zero-Day LAP: Enables borrowing beyond the agreement value by leveraging the property’s higher market value.

-

OVERVIEW

-

FEATURES

-

ELIGIBILITY & DOCUMENTS

Profectus Capital offers tailored financial solutions to help MSMEs in manufacturing and service sectors acquire essential machinery. From CNC and injection moulding machines to medical equipment, we finance a wide range of tools across industries like manufacturing, healthcare, packaging, food processing, and more. Our expertise ensures businesses can enhance efficiency, boost competitiveness, and achieve long-term business growth.

Loan Purpose:

- Expand production capacity to meet demand.

- Upgrade machinery for better efficiency and cost savings.

- Acquire advanced technology to stay competitive.

- Improve product quality to meet industry standards.

- Loans for new and used machinery (Printing & Healthcare sectors for used).

- Flexible tenure up to 4 years.

- Funding: Up to ₹3 Cr for machinery, ₹2 Cr for solar panels.

- No secondary collateral required.

- High LTV ratio for reduced upfront costs.

- Cash flow-based assessments for tailored terms.

- Special schemes with OEMs.

- ₹50 Lakh loans for first-time machinery buyers (traders).

-

OVERVIEW

-

FEATURES

-

ELIGIBILITY & DOCUMENTS

Solar energy offers MSMEs, schools, hospitals, and commercial enterprises an effective way to reduce energy costs, improve efficiency, and support sustainability. Profectus Capital provides tailored financing for solar panel installations, allowing businesses to save on energy costs and enjoy free electricity after loan repayment.

Why Choose Profectus?

- Quick & Easy Application: Digital, hassle-free process.

- Collateral-Free Financing: Borrow up to ₹1 Crore without additional collateral.

- One-Time Investment, Lifetime Savings: Save on energy immediately and enjoy free power post-repayment.

- Positive Environmental Impact: Lower energy costs and reduce your carbon footprint.

- Higher Loan Amounts: Financing up to ₹3 Crore for solar energy needs.

- Flexible Repayment: Terms up to 4 years, based on your cash flow.

- Solar Panel Capacity: Financing for systems from 15 kW to 100 MW.

- No Secondary Collateral: No additional collateral required for loans up to ₹1 Crore.

- High LTV Ratio: A high LTV ratio covers most of the panel costs, reducing upfront investment.

-

OVERVIEW

-

FEATURES

-

ELIGIBILITY & DOCUMENTS

At Profectus Capital, we understand the pivotal role K-12 schools play in shaping India’s future. To stay competitive, schools need more than just skilled teachers—they need modern infrastructure, advanced educational technology, and spaces that promote holistic learning. Whether it’s expanding facilities, adding classrooms, or adopting sustainable practices like solar panels, these investments attract more students and improve financial health.

Profectus Capital offers flexible financing to help schools modernize their infrastructure and embrace green energy, supporting your commitment to academic excellence and long-term growth.

- Hassle-Free Login: Fully digital, seamless application process.

- Flexible Loan Terms: Loans from ₹25 lakh to ₹5 crore, with repayment tenures between 2 to 7 years.

- Quick Approvals: Approvals within 3 to 7 working days, based on actual cash flow assessments.

- Flexible Collateral: Accepts school properties or individual residential/commercial properties as collateral.

- Support for Non-Metro & Rural Areas: Financing available for schools in both urban and rural areas.

- High LTV Ratio: Up to 80% LTV ratio based on property market value for larger loan amounts.

-

OVERVIEW

-

FEATURES

-

ELIGIBILITY & DOCUMENTS

Supply Chain Finance (SCF) optimizes working capital by enhancing supply chain liquidity, reducing financial pressure, and boosting operational efficiency. Profectus Capital offers tailored SCF solutions, including Distributor Financing, Vendor Finance/Bill Discounting, and Merchant Cash Advance, to streamline supply chains and improve financial health.

- Faster Payments: Access funds quickly, pay suppliers on time, and strengthen relationships while benefiting from early payment discounts.

- Improved Cash Flow: Free up capital tied in receivables to invest in inventory, expand offerings, or cover operational costs.

- Flexible Financing: Choose from revolving credit, bill discounting, or merchant cash advances tailored to your needs.

-

OVERVIEW

-

FEATURES

-

ELIGIBILITY & DOCUMENTS

Non-Banking Financial Companies (NBFCs) play a key role in driving financial inclusion in India. To support their growth, Profectus Capital offers flexible Term Loans for onward lending, enabling NBFCs to expand their portfolios and serve more customers. With a focus on corporate governance, ethical lending, and innovation, we also explore Strategic Alliances with other NBFCs to drive mutual growth and create new opportunities.

- Term Loans: Funding for new portfolio creation, expanding lending capacity.

- Structured Offerings: Pool purchases and customized finance solutions to improve liquidity and strengthen balance sheets.

EMI Calculator

Your Loan EMI ₹ PER MONTH

Total Interest: ₹

Processing Fees: ₹

TOTAL: ₹

the country

in Rs.Crs

Check the latest industry innovations and events.

Don’t just take our word for it—hear from the businesses we’ve helped progress!

Mr. R. Prabhakar – Managing Trustee, Revur Padmanabha Chettis Educational Trust

“With over four decades in education, we aimed to expand with a new CBSE school in Chennai. Profectus Capital supported us at a critical stage—with a transparent process, ethical practices, and timely funding. Thanks to their partnership, we began construction and welcomed over 600 students. A truly dependable growth partner!”

Mr. Suresh Babu – Managing Director Rustopper Packtech

“With over 20 years in anti-corrosive packaging, our expansion across India wouldn’t have been possible without the unwavering support of Profectus Capital. Their timely machinery and capex loans helped us grow from 3 to 350 employees. Their proactive guidance and transparent process make them more than a lender—they’re a true financial partner in our journey from ₹80 CR to our ₹500 CR vision.”

Mr. Pradeep – Chennai Foods

“Founded by my father in 1995, Chennai Foods has become a key supplier of sauces and jams across Tamil Nadu. When we needed to shift to a commercial facility to scale up production, Profectus Capital supported us with a mortgage loan. Their simplified process, MSME-friendly approach, and quick approval helped us triple our production capacity. With their continued support, we now aim to expand across South India. I confidently rate them 10/10.”

Mr. Madhavan – Mathavan Prints

“Since 2004, we’ve been serving local and global clients printing solutions. To scale operations and improve quality, we invested in advanced machinery with the support of a loan from Profectus Capital. Their low interest rates and seamless process helped us boost production by 50x without compromising on quality or timelines. Choosing Profectus was one of the best decisions for our business growth.”

Mr. Guru Murthy – Correspondent & Managing Trustee – Sri Rukmani Vidyalaya

“We’ve grown from a nursery in 1979 to a higher secondary school with 650+ students. To expand, we needed funds to acquire land and upgrade infrastructure. Profectus Capital supported us with a timely loan and exceptional service, helping us enhance our campus with smart classrooms and better facilities. Their continued support over the past six years has been vital to our growth. I proudly rate them 10/10.”

Mr. Rakesh Kumar, Oxford Green School, Noida

“We connected with Profectus Capital when we wanted to enhance the infrastructure, modernise classrooms, labs, and facilities. Their school loan enabled us to drive a 25% rise in admissions. Their responsive service gives us confidence to grow further with them.”

Mr. Sahil Pahuja, Jospo Cooler, Delhi

“In 2022, as we set up our manufacturing unit, funding an injection moulding machine was a major challenge. A machinery loan from Profectus Capital helped us scale operations, bring manufacturing efficiencies, cut production costs, and expand our market reach.”

Mr. Arun Goel, Fortis Chairs, Haryana

“We approached Profectus Capital in 2024 as we were looking to expand our business. Their mortgage loan helped us shift and scale our plant from producing up to 50 chairs to over 1,000 per day.”

Mr. Anand Goyal, Pacific Laminates

“Profectus Capital has a professional approach and dedicated team to provide finance for various needs. For my industry, my first choice would be Profectus Capital because we had a great experience with them both in terms of fast approval and smooth loan disbursal.”

Mr. Panchakshariah, Hari Om Printers

“Compared to bank’s long waiting period, Profectus Capital’s quick turnaround time and smooth loan process was a blessing. Their understanding of my funding needs and viability-based assessment approach helped me grow my business. I would certainly recommend Profectus for equipment finance to others.”

ENQUIRE NOW

Apply for loan now