About Profectus Capital

Profectus Capital, derived from the Latin word for ‘progress,’ is committed to empowering MSMEs and schools with tailored financial solutions. Headquartered in Mumbai, with a pan-India presence across 26 locations, we provide customised business financing solutions designed to drive sustainable progress.

Our expertise spans manufacturing, services and education sectors, offering tailored SME loans such as business expansion term loans, working capital term loans, machinery & equipment finance, rooftop solar finance, supply chain finance, and NBFC finance.

We specialize in future cash flow-based underwriting to ensure businesses get the right financial support for their specific needs.

As of 2025, UGRO Capital has acquired Profectus Capital, making it a wholly owned subsidiary. This strengthens UGRO Capital’s position of building India’s largest MSME lending institution.

UGRO Capital Limited (NSE: UGROCAP I BSE: 511742) is a Data Tech Lending platform, listed on NSE and BSE, pursuing its mission of “Solving the Unsolved” for the small business credit gap in India, on the back of its formidable distribution reach across 300+ locations, and its Data-tech approach.

Our Vision

- We are committed to bringing business financing solutions to support their sustainable progress.

- We understand each business aspires to differentiate itself in this competitive space by being innovative and agile in its approach. Funding must thus be matched with precise requirements for maximum efficiency.

- We will play the part of a supportive, sustainable and continuous financing partner thus realising our vision of being partners in progress to small and medium businesses.

Our Mission

- We are committed to helping MSMEs secure credit and boost their growth prospects.

- At Profectus Capital, we prioritize customer-centric policies, transparent processes, and the use of technology to develop effective financial solutions.

- Our workflows are designed with flexibility in mind, ensuring that each unique aspect of an MSME's operations is considered in decision-making while safeguarding the interests of our stakeholders.

Our Values

These values are deeply embedded in every step of our journey with our partner MSMEs.

Innovation

We continuously innovate our lending solutions to meet the evolving needs of MSME businesses, delivering what matters most to their progress and success.

Transparency

We are committed to clear, honest communication, building trust and fostering long-lasting relationships with all our stakeholders.

Responsibility

We take our commitment to the progress of the MSME sector seriously, striving to create lasting value for businesses across India.

Integrity

We are steadfast in doing the right things the right way, maintaining the highest ethical standards in all our actions.

Empathy

We deeply care about the success of our stakeholders and value the diverse perspectives that guide us in making decisions.

Our Reach

Profectus Capital has a strong presence with 26 locations in key cities across Maharashtra, Gujarat, Karnataka, Telangana, West Bengal, Tamil Nadu, Delhi NCR, Haryana, Rajasthan, Andhra Pradesh, Assam, Punjab, Chhattisgarh, and Madhya Pradesh. We’re actively expanding our network to ensure that MSMEs in industrial hubs across the country have the support they need to thrive.

Each of our branches offers innovative, customised credit solutions that are tailored to the unique economic needs of each region. With our deep experience in MSME financing, we’re able to provide trusted products and services that are aligned with the specific requirements of businesses in every location we serve.

Our Investors

Since its founding in 2004, Actis has raised US$19 billion in capital and has expanded its team to over 300 professionals, including 120 investment experts working across 17 global offices. Actis’ investment funds span 70 companies, collectively employing over 116,500 people worldwide, demonstrating the firm’s broad impact and influence.

Our Leadership Team

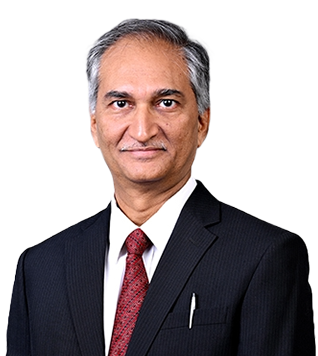

KV Srinivasan

Executive Director &

Chief

Executive Officer

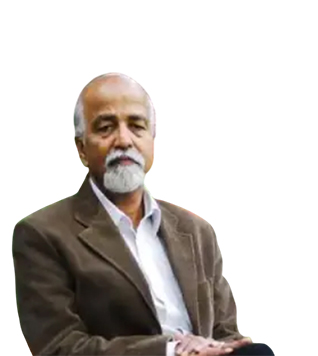

Sandip Parikh

Chief Operating Officer

Nimesh Parikh

Chief Risk Officer

Zubeen Mehrotra

Chief Business Officer

Vitthal Naik

Chief Technology Officer

Priyanka Pathak

Chief Human Resource Officer

Sharad Agarwal

Chief Executive Officer

Rajesh Thakur

Chief Financial Officer

Sweety Jain

Head - Credit

Ganesh Aparaj

Head - Collections

Bharat Mahapatra

Head - Business

Voice of our customers

Mr. R. Prabhakar – Managing Trustee, Revur Padmanabha Chettis Educational Trust

“With over four decades in education, we aimed to expand with a new CBSE school in Chennai. Profectus Capital supported us at a critical stage—with a transparent process, ethical practices, and timely funding. Thanks to their partnership, we began construction and welcomed over 600 students. A truly dependable growth partner!”

Mr. Suresh Babu – Managing Director Rustopper Packtech

“With over 20 years in anti-corrosive packaging, our expansion across India wouldn’t have been possible without the unwavering support of Profectus Capital. Their timely machinery and capex loans helped us grow from 3 to 350 employees. Their proactive guidance and transparent process make them more than a lender—they’re a true financial partner in our journey from ₹80 CR to our ₹500 CR vision.”

Mr. Pradeep – Chennai Foods

“Founded by my father in 1995, Chennai Foods has become a key supplier of sauces and jams across Tamil Nadu. When we needed to shift to a commercial facility to scale up production, Profectus Capital supported us with a mortgage loan. Their simplified process, MSME-friendly approach, and quick approval helped us triple our production capacity. With their continued support, we now aim to expand across South India. I confidently rate them 10/10.”

Mr. Madhavan – Mathavan Prints

“Since 2004, we’ve been serving local and global clients printing solutions. To scale operations and improve quality, we invested in advanced machinery with the support of a loan from Profectus Capital. Their low interest rates and seamless process helped us boost production by 50x without compromising on quality or timelines. Choosing Profectus was one of the best decisions for our business growth.”

Mr. Guru Murthy – Correspondent & Managing Trustee – Sri Rukmani Vidyalaya

“We’ve grown from a nursery in 1979 to a higher secondary school with 650+ students. To expand, we needed funds to acquire land and upgrade infrastructure. Profectus Capital supported us with a timely loan and exceptional service, helping us enhance our campus with smart classrooms and better facilities. Their continued support over the past six years has been vital to our growth. I proudly rate them 10/10.”

Mr. Rakesh Kumar, Oxford Green School, Noida

“We connected with Profectus Capital when we wanted to enhance the infrastructure, modernise classrooms, labs, and facilities. Their school loan enabled us to drive a 25% rise in admissions. Their responsive service gives us confidence to grow further with them.”

Mr. Sahil Pahuja, Jospo Cooler, Delhi

“In 2022, as we set up our manufacturing unit, funding an injection moulding machine was a major challenge. A machinery loan from Profectus Capital helped us scale operations, bring manufacturing efficiencies, cut production costs, and expand our market reach.”

Mr. Arun Goel, Fortis Chairs, Haryana

“We approached Profectus Capital in 2024 as we were looking to expand our business. Their mortgage loan helped us shift and scale our plant from producing up to 50 chairs to over 1,000 per day.”

Mr. Anand Goyal, Pacific Laminates

“Profectus Capital has a professional approach and dedicated team to provide finance for various needs. For my industry, my first choice would be Profectus Capital because we had a great experience with them both in terms of fast approval and smooth loan disbursal.”

Mr. Panchakshariah, Hari Om Printers

“Compared to bank’s long waiting period, Profectus Capital’s quick turnaround time and smooth loan process was a blessing. Their understanding of my funding needs and viability-based assessment approach helped me grow my business. I would certainly recommend Profectus for equipment finance to others.”

ENQUIRE NOW

Apply for loan now