Frequently Asked Questions

What type of Loans does Profectus Capital provide?

Profectus Capital provides secured loans for income generating purposes to SMEs in Manufacturing and Service Sectors operating in eleven identified Industry-Clusters.

The main loan products are:

- Enterprise Mortgage Loan: Property Backed Business Expansion Loans

- Machinery and Equipment Funding

- School Funding Program: K12 Schools for upgrading facilities

- Supply Chain Solutions: Anchor backed Dealer Financing, Bill

- Discounting and Vendor Financing

- Merchant Cash Advances: POS based daily repayment type Business Loans

Credit assessment is cash-flow based thus addressing precise funding requirements of SMEs in identified clusters.

How can I apply for a loan?

You can apply for a loan:

- By clicking on Enquire Now

- Sending an email to customercare@profectuscapital.com

- Call our Customer Service Helpline No 022-4919-4400 and Relationship Managers from Profectus Capital will reach out to take the process ahead.

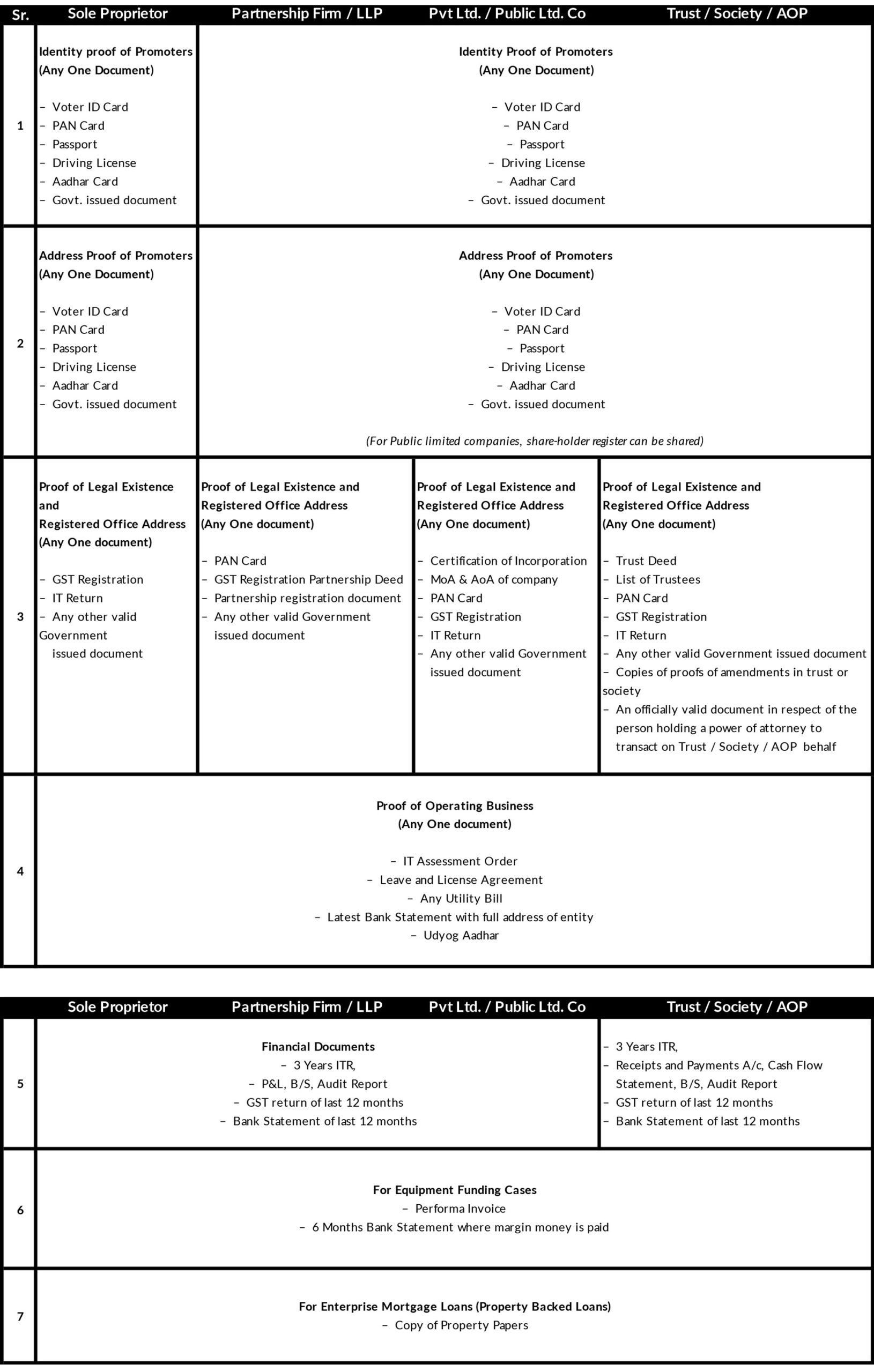

What are the basic documents required to apply for loan?

What is the loan approval process and How soon can Profectus fund my business?

Who is a Co-Applicant? Does every loan require a Co-Applicant?

A Co-Applicant is a person who is applies along with the main applicant for a loan and can be an immediate family member with a separate identifiable income steam. Co Applicant’s income is used to supplement the applicant’s income during credit assessment for the loan and he/she is equally responsible for repayment of the loan.

Since having a co-applicant improves the chances of loan sanction given a better consolidated financial position, it is advisable to have a creditworthy Co-Applicant on the loan structure..

Who is a Guarantor?

How much Loan amount can Profectus Offer?

Profectus Capital offers loans based on customer requirement and Free Cash Flows (repayment capacity) of customer business.

Ticket sizes range between Rs.25 lacs to Rs. 500 lacs.

Loan to Value ratios are generally in 30%-70%# bracket for Property backed loans and up to 85%# in Machinery and Equipment Funding programs.

# (LTVs are dynamic and can vary from case to case)

What is Loan to Value Ratio (LTV)?

What will be the Interest Rate of such a loan?

How is Interest Calculated on Loans?

What is maximum loan tenure offered by Profectus Capital?

What are the loan documents I will need to sign and complete as part of Loan?

Along with Loan Documents, Repayment Instruments like NACH or Post-Dated Cheques and Security Cheques will also have to be submitted.

What are acceptable repayment modes for the loan?

How can I get my address changed in my Loan Account?

How can I obtain duplicate repayment schedule for my loan account?

How can I change the mode of repayment for my loan account?

What will be done with Post Dated Cheques, if I request to change to NACH / e-NACH mode?

Are there any additional charges for loan repayments?

There are no additional charges for loan repayments in normal course of repayments. In case of NACH / PDC or repayment instrument bounces, Bounce Charges will be applicable. You can visit Interest Rate and Schedule of Charges section on our website www.profectuscapital.com to know more.

When will I get No Dues Certificate for my loan?

How can I pre-close my loan? Are there any charges on such pre-closure?

For pre-closures, Applicant or Co-applicant have to visit the nearest branch along with authority letter signed by all applicant and co-applicant with self-attested KYC documents for raising the request of pre-closure Statement, our relationship manager would provide you with necessary assistance.

In case a request is received from the borrower for pre-closure statement, the Company will communicate its consent or any objections within 21 days from the date of receipt of the request as per the Master Direction – Reserve Bank of India (Non-Banking Financial Company – Scale Based Regulation) Directions, 2023 dated October 19, 2023. You may refer to Schedule of charges for the charges payable on pre-closure.